Someone from

InvestorVillage posted a NVDA collar trade:

long 100 shares of stock - $33.95

Sold Nov 32.5 Call - $ 2.65

Bought Dec 30 Put - $ 1.05

Margin required: $3000+

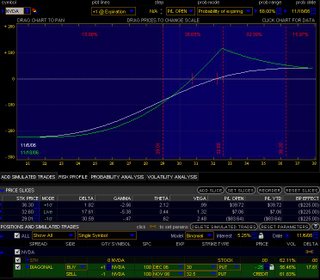

The covered call portion (long stock-nov call) is a synthetic equivalent to a short naked put. Thus the whole collar is the same as a nov/dec diagonal spread:

-nov 32.5p

+dec 30p

Margin required: $225

NVDA will announce their numbers, Nov 9th.

No comments:

Post a Comment